Assisted living facilities have become a hot topic in investing because of the growing demand, potential revenue, and recession-resistant nature of the assisted living industry. Professional and novice investors alike have seen the scaleable success that has come to men and women who have no real estate background or business ownership experience, and now they are rushing to find their seat at the table.

Perhaps that’s why you’re here. You’ve heard the stories, seen the statistics, and now you’re intrigued by the promise of assisted living. When you find your seat on the team, you’ll be met with a myriad of ways you can get your start in the assisted living business.

The senior living industry has been one of very few industries to see continual (and predictable) growth over the past decade despite economic downturns and market volatility. Financial experts have seen the demographic projections of America’s population, indicating that the demand for senior housing is expected to increase for the next two decades.

What’s Driving the Demand for Assisted Living Facilities?

The need for assisted living is growing due to several factors, primarily an aging US population. There is an increasing number of older adults who require assistance with activities of daily living.

Eventually, just about every human will come to a point where they require assistance with basic daily activities, and this basic reality is the source of the demand for assisted living.

Unfortunately for our seniors, the options for comfortable housing with quality care are limited. We are currently living in a senior housing crisis as there are not enough quality options to fulfill the demand of the population.

If there is a constant and growing need for senior living services, why isn’t the market expanding to meet that demand?

Residential Assisted Living Academy has a lot to say about the senior housing crisis, including breaking down the relevant data and market factors that have led to the massive demand for senior care.

To summarize, here are some of the principal reasons why the need for assisted living is growing.

Aging population

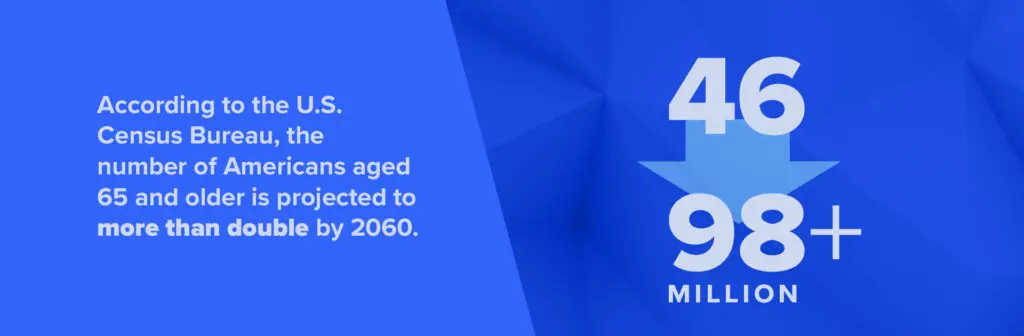

According to the U.S. Census Bureau, the number of Americans aged 65 and older is projected to more than double by 2060, from 46 million to over 98 million.

This increase is directly seen in the difference between the birth rate of the Silent Generation (those born 1928 to 1945 and who currently occupy most of the beds in senior care homes) and the much higher birth rate of the Baby Boomer generation (those who are starting to move into senior care homes and will drive the industry for the next two decades).

This demographic shift is primarily driving the demand for senior care services, including assisted living.

Longer life expectancies

Medical care and technological advances have led to longer life expectancies, resulting in more people living into their 80s and 90s. While many seniors are healthy and independent, a significant portion requires assistance with daily activities due to age-related health issues.

Increased chronic health conditions

Chronic health conditions such as diabetes, heart disease, and dementia are becoming more prevalent among older adults. These conditions often require ongoing medical care and support, which can be provided in an assisted living setting.

Greater awareness of senior care options

As people become more educated about senior care options, including assisted living, they are more likely to seek these services for themselves or their loved ones.

Changing family dynamics

With more adults working full-time and families spread out geographically, less family support is available to care for older relatives. Assisted living can provide a supportive and safe environment for seniors who do not have family members available to care for them.As demand for senior care services continues to increase, the assisted living industry will likely continue to grow and evolve to meet the needs of older adults, and this growth in demand creates a unique opportunity for those who want to step up to provide the necessary housing and care services.

Types of Senior Care In Assisted Living Facilities

When people first learn about the investment potential in the senior housing industry, they often ask questions like, what is the difference between residential care and assisted living facilities? Or, how is a nursing home different from a personal care home?

There are so many terms used to describe the various types of senior care:

- Assisted living facilities

- Senior living apartments

- Residential care facilities

- Private assisted living homes

- Nursing homes

- Big-box assisted living facilities

- Personal care homes

- Independent living homes

Some of these terms are used interchangeably. The bottom line is that the name isn’t as important as the function or the services provided to the residents and their families.

In this article, we will say residential assisted living when referring to RAL homes and nursing homes when referring to everything else.

To get a sense of the landscape in the assisted living industry and assess the opportunity, it helps to look at the current market and where seniors reside.

Assisted Living Statistics in the United States

The average size of an assisted living community in the United States is 33 residents.

In terms of who owns these facilities, of the nearly 30,000 assisted living communities in the country, slightly more than half are chain affiliated (often by large national corporations), with about 42% being independently owned.

One of the things that investors need to know before starting a residential assisted living facility is the competition they will encounter in this market. A substantial percentage of people living in senior care facilities reside in nursing homes. It is the model that people usually think of when they hear the term senior care.

Nursing homes and residential assisted living homes are both types of senior living options, but they differ in several critical ways.

What is a Nursing Home?

A nursing home, also known as a skilled nursing facility or long-term care facility, is a care setting that provides around-the-clock medical care and support services to individuals who require assistance with activities of daily living. Nursing homes are specially designed to provide a safe and secure environment for seniors and individuals with disabilities who are unable to live independently.

Many nursing homes can provide a wide range of services, including medical care, medication management, rehabilitation services, social and recreational activities, and personal care.

Medical care is usually provided by licensed healthcare professionals such as registered nurses, licensed practical nurses, and certified nursing assistants trained to manage complex medical conditions and assist seniors.

Rehabilitation services include physical therapy, occupational therapy, and speech therapy that help improve their overall function and can even help individuals recover from injuries or illnesses.

What is a Residential Assisted Living Home?

The main difference between the smaller residential care home and the big-box assisted living facilities is the level of medical care provided.

Residential assisted living is a type of senior living accommodation that helps with daily living activities, such as bathing, dressing, and grooming but does not provide advanced medical care.

Residential assisted living homes help with daily living activities, such as bathing, dressing, and grooming but does not provide advanced medical care.

Residents in residential assisted living communities generally do not have severe medical conditions that require 24-hour medical supervision. Instead, they need help with everyday tasks and benefit from the social interaction and companionship of living in a community.

Residential assisted living homes are typically smaller than nursing homes and provide a more home-like environment. They are not as heavily regulated as nursing homes, although all states have licensing requirements and regulations to ensure the safety and well-being of residents.

Similarities Between Nursing Homes and Residential Assisted Living Facilities

Both types of senior living offer social and recreational activities to promote mental and emotional well-being. These activities may include arts and crafts, music therapy, games, and other leisure activities.

Personal care services such as bathing, grooming, and dressing are also provided to help individuals maintain their hygiene and appearance.

The government regulates nursing homes and residential assisted living homes, and they must meet strict standards of care. However, due to the size, additional skilled medical staff, and service levels, more stringent regulations are applied to big-box facilities.

A combination of private pay, government programs such as Medicaid and Medicare, and private insurance typically funds nursing homes and residential assisted living homes. The most common form of payment is private pay, meaning that seniors or their families pay for the services out of their own pockets.

Medicaid and Medicare are government programs that provide financial assistance to eligible individuals who need long-term care services. Private insurance may also cover some or all of the costs of nursing home care.

Choosing the right senior housing solution for an elderly family member can be challenging. There are many factors to consider, including location, quality of care, staffing ratios, and startup cost, just to name a few. It is necessary to research different options, tour the facilities, and speak with staff and residents to get a sense of the environment and level of care provided.

Differences Between Nursing Homes and Residential Assisted Living Homes

Although they have many similarities and overlapping areas of care, the difference between the average nursing home and the average residential assisted living home can be drastic.

Nursing homes often provide much more extensive medical care, but that care is provided in a sterile, hospital-like environment. RAL homes offer a familiar and comfortable environment that feel much more like a home, and the atmosphere is closer to what senior residents have been accustomed to their entire lives.

Safety is a significant issue in senior housing. One of the biggest lessons the industry learned during the pandemic was that amassing large numbers of vulnerable seniors into one large facility isn’t the best option for safety.

Many big-box facilities saw devastating results as the virus spread throughout their residents. RAL homes, on the other hand, were more adept at minimizing the risk to seniors with both prevention and mitigation procedures. Their smaller occupancy meant that even if a resident got sick, they weren’t in jeopardy of spreading it to a large population of seniors.

In a nursing home, residents often feel like they are just a number, losing the sense of comfort and community. The big-box nursing homes see a turnover rate with residents and staff. This constant change of faces can be difficult for seniors, resulting in a loss of companionship and a sense of belonging. Studies have shown that loneliness and lack of regular community can significantly impair health.

For seniors to have health and longevity, they need more than physical treatment. They need to be cared for, listened to, and treated like they matter because they do matter.

Seniors need to be cared for, listened to, and treated like they matter because they do matter.

Seniors in a residential assisted living home see the same staff every day. Consistency in those providing their care and support is comforting. And because RAL staff members only need to care for 6-10 seniors, the intimacy, personalization and genuine heart for each senior is more easily established and nurtured.

In a big-box nursing home, everything is regimented and uniform throughout the facility, with little regard for individual needs.

However, in a RAL home, the amenities and services can be much more personalized to the needs and wants of each resident. Meals, entertainment, activities, and personal space can all be tailored to specific residents.

These amenities combine with the comfort and coziness of living in an actual home to provide residents with the closest atmosphere to living in their own homes while providing the extra care and assistance they require.

The bottom line is that living in a large nursing home will never adequately compare to occupying a smaller space with friends that feels like home.

Why Smaller Assisted Living Homes Are Better

Most assisted living homes provide a range of services to help seniors who need assistance with daily activities, but not all facilities are created equal.

While some commercial assisted living homes are big facilities with up to a hundred residents, others are smaller residential homes that accommodate 6 to 15 residents.

Both have advantages depending on what the residents and their families require.

However, on the whole, smaller assisted living facilities have many more positives for older adults. There are several reasons why smaller assisted living homes may be better for seniors.

A smaller assisted living home:

- Offers a more personalized and intimate environment. Residents in smaller homes can form closer relationships with staff and other residents. It helps seniors feel more comfortable and secure in their assisted living homes.

- Has a higher staff-to-resident ratio, meaning that each resident receives more individualized attention and care. It helps ensure that residents receive the necessary support and assistance with daily activities and more personalized attention to their medical needs.

- Offers a more homelike atmosphere. It helps reduce stress and anxiety among residents and promotes a sense of security and familiarity, assisting seniors to feel more comfortable and at ease in their assisted living homes.

- Offers more flexible and personalized care plans. Staff members in smaller homes can often tailor care plans to meet the individual needs of each resident rather than presenting a one-size-fits-all approach to care.

- Is generally more affordable than larger facilities. It’s because smaller homes have lower overhead costs and can operate with a smaller staff. This makes smaller assisted living homes a more financially feasible option for seniors on a fixed income.

Finally, one of the most significant reasons that smaller assisted living homes are the better option for seniors is due to health and safety concerns. Dealing with COVID-19 these past few years has taught us an important lesson regarding the safety of our elderly population.

Smaller residential assisted living homes can often be safer during a pandemic for several reasons, including:

- Lower population density. Smaller residential assisted living homes typically have fewer residents than more extensive facilities. With fewer people living in close proximity, there is a lower risk of the virus spreading from one resident to another. Social distancing is easier to achieve in smaller homes, and residents are less likely to come into contact with people outside their immediate living environment.

- More personalized care. Smaller residential assisted living homes often have a higher staff-to-resident ratio. Caregivers can better monitor residents’ health and well-being and respond quickly if any symptoms of illness arise.

- Easier to control infection. In a smaller residential assisted living home, it is easier to prevent illness by implementing measures like frequent disinfection of common areas, monitoring visitors and staff for symptoms, and restricting access to the facility. It helps reduce the risk of a COVID-19 outbreak and ensures that cases are identified and contained quickly.

- Lower staff turnover. Smaller residential assisted living homes may have lower staff turnover than more extensive facilities. It means that staff members are more familiar with the residents and their needs, reducing the risk of errors or miscommunications that can compromise safety.

- More homelike environment. Residents in smaller homes are more likely to have private rooms or shared living spaces that resemble a traditional home environment, which can be especially important during a pandemic.

All these factors help reduce the risk of virus transmission and provide a safer and more secure living environment for the elderly.

If safety and comfort are the concern, smaller assisted living homes are the way forward. They offer many benefits that help seniors feel more comfortable and secure in their assisted living homes, ensuring seniors receive the individualized care and attention they need to maintain their quality of life.

What Assisted Living Model Do Seniors Prefer?

All of the elements we’ve discussed so far point to smaller is better. But what do seniors prefer? What do seniors want in an assisted living home?

To be perfectly honest, most seniors would generally prefer to stay in their own homes. However, when health issues arise that make this an unsafe option, the choice between the various types of senior care needs to be considered.

And when making this decision, most seniors prefer the smaller residential-style assisted living homes for good reasons.

As people age, they carry their histories, experiences, hopes, and desires; these don’t fade away simply because they are elderly. Yet, so many in the senior care industry have adopted a model that often treats seniors as if they are just another number… just another regular check that will come in every month for the accommodations and services provided.

It is why nursing homes and big-box facilities generally feel like cold and sterile places where large numbers of seniors are housed and looked after by a sizable and often overworked staff.

Thankfully, this tradition of placing large numbers of elderly into massive facilities is being challenged by many smaller boutique options. For those who care about the quality of the lives of the aged, the big-box model is seen more as an antiquated and less-than-ideal choice.

First and foremost, seniors want to feel safe and secure in their living environment. They want to know that they will be well taken care of, that their needs will be met, and that they can trust the staff and caregivers at the facility. It is much more easily accomplished in a smaller environment where the team knows each resident and their needs.

Senior residents also want to maintain their independence as much as possible. They want to be able to make their own decisions, manage their daily routines, and have some semblance of control over their lives. It means having access to transportation, the ability to participate in activities and events, and the opportunity to socialize with other residents on their terms.

Seniors overwhelmingly prefer a comfortable environment that feels like home. They want a clean, well-maintained living space with comfortable furniture and amenities that make daily life easier. They also desire access to nutritious meals and snacks and enjoy their favorite hobbies and activities.

And most importantly, seniors want to feel valued and respected by the staff and other residents at the assisted living facility. They want to be treated with dignity and kindness and have their individual needs and preferences respected. It includes having open, honest communication with staff and feeling like they are part of a community of people to care about them. It is much more challenging to accomplish in a big-box facility with so many staff coming and going all the time and higher staff turnover rates.

Smaller, residential-style assisted living homes that are run well are usually able to retain quality staff, and the lower staff-to-resident ratios ensure that seniors have more personalized care provided by familiar faces.

Safety and quality of life of senior residents should always be the highest concern for any assisted living owner or operator, regardless of the business model.

Why Investors Choose Smaller Assisted Living Facilities

Once you have a fundamental understanding of the functional differences between a nursing home and a residential assisted living facility, you need to discern the financial differences between the two options, including the potential for cash flow.

Investing in residential assisted living businesses can be quite a lucrative venture; your success as an investor ultimately depends on several important factors. Compared to other investments such as stocks, real estate, or mutual funds, the potential returns and risks associated with investing in residential assisted living businesses may be different.

Among all of the reasons to choose smaller assisted living for investing, it cannot be overstated how significant the opportunity to do good plays into the choice to pursue smaller residential homes.

Among all of the reasons to choose smaller assisted living for investing, it cannot be overstated how significant the opportunity is to do something good for the community.

The stories of abuse, poor living conditions, exploited seniors, and other less-than-ideal senior home experiences have created an opportunity to elevate the quality of care for our seniors, and residential assisted living homes offer the ideal environment to see this change happen.

For many investors, the promise of doing good for others is a powerful motivator.

Advantages of Investing In Residential Assisted Living Facilities

One of the most substantial advantages of investing in residential assisted living businesses is the demand for senior housing is increasing year-over-year, and RAL provides a scalable business model that is easier and more agile to implement on-demand… without sacrificing the quality of care.

Residential assisted living businesses offer a valuable service to seniors who require assistance with daily activities but do not require the level of medical care often provided by nursing homes.

Another advantage of investing in the residential assisted living business model is the potential for a steady and reliable income stream.

Unlike other industries supply and demand relationship, this reliability is not as volatile or directly dependent on what the markets are doing. Because the services provided are services of necessity, a down market isn’t going to see seniors moving out of their care homes, as might happen in industries that offer less essential services.

The recession of 2008 and the pandemic of 2020 were great examples of how vital senior care services are to Americans. When a family is hit financially, they often cut luxuries and minor necessities, but they will generally not move their elderly loved one out of a senior care environment.

The recession of 2008 and the pandemic of 2020 were great examples of how vital senior care services are to Americans.

As far as the income for residential assisted living owners and operators, it all depends on how you structure your business and manage your hours and expenses. At the Residential Assisted Living Academy, we have worked with thousands of industry professionals, owners of assisted living homes, and experienced financial planners to put together the very best model for entrepreneurs to adopt when building and managing their RAL business.

See the potential for cash flow using our free Residential Assisted Living Profitability Calculator

These businesses typically generate revenue through resident fees, which can provide a predictable source of income. Additionally, residential assisted living businesses may offer opportunities for recurring revenue, such as through contract agreements with government agencies or health insurance providers.

As with any business venture, investing in residential assisted living businesses also comes with risks.

The success of a business depends on various factors such as location, marketing, branding, competition, and regulatory compliance. The quality of services offered and the competence and compassion of management and staff can also have a major impact on the business’s success.

Compared to other investments, such as stocks or mutual funds, investing in residential assisted living businesses has the potential for higher returns and long-term financial success.

The Business and Real Estate Plays of Residential Assisted Living

Unlike traditional real estate investing, the residential assisted living business model encompasses two sources of equity.

The property or home one buys to run the business is a tangible asset that will appreciate over time, depending on standard real estate factors like location, market strength, etc.

In addition, the enterprise, i.e., the brand, reputation in the community, policies and procedures, staff, etc., is a separate entity that builds equity over time. And when the investor decides that they no longer want to be in the assisted living industry, they have the option to sell either their business and their real estate separately or sell them both together.

Both options are standard practices in the assisted living space.

While you can start your own assisted living business from scratch, there is also the opportunity to purchase an assisted living business for sale, which allows you to begin earning revenue right away.

The Income Potential of Residential Assisted Living Facilities

When you compare the financials of the two most common options for senior living, the picture becomes even more stark.

According to a 2021 Cost of Care Survey by Genworth, a private room in a big-box nursing home costs about $9,034 per month. On the other hand, a private room in a residential assisted living home costs just half that at about $5,350, on average.

On the surface, it may appear there is more money to be made running a big-box nursing home. However, the devil is in the details.

Big-box facilities have to charge more because they have higher overhead, massive buildings to maintain, and large staff payroll.

In addition, many of these larger facilities are developed and managed by companies that answer to boards and shareholders whose primary interests are often financial. While the assisted living industry largely began as a means of taking care of seniors whose family and friends were not able to care for them, these facilities have ballooned into a capitalistic model where the bottom line is often put above care and quality of life for residents.

Going back to the numbers, what do these differences mean for investors and potential business owners?

Here are a few things to consider:

- It is easier to fill a resident vacancy at $5,350 per month than $9,000 per month.

- Maintaining a maximum occupancy is easier at 8-12 residents per facility than at 30-40 residents per facility.

- Facilities have to charge high amounts to cover their higher expenses.

These are just a few of the financial reasons investors and businessmen and women are choosing residential assisted living. RAL is quickly becoming the most profitable and in-demand model emerging in assisted living.

Smaller care homes are establishing their place in this market, and consumers are realizing their ability to provide an enhanced level of care for seniors in an environment they would prefer.

Get Your Start In Residential Assisted Living

Residential assisted living is not a new concept. Our late Founder, Gene Guarino, learned about RAL way back in the 90s, but it wasn’t until his mother needed care that he gave it a serious look.

After opening up his first home as a way of caring for his mother, Gene opened two additional facilities, documenting his journey and creating a blueprint others could follow to duplicate his success.

The investment potential is huge in the senior living space. The potential to do good in an industry that has been equated with shady and subpar practices is even greater!

Nearly everyone will play a role in assisted living, and because we are still in the early stages of this emerging business opportunity means you can choose which role you’d like to play.

- Own the real estate.

- Own the business.

- Own both.

- Write a check to another business owner for your own care one day.

Everything in residential assisted living happens on a smaller scale (except for the cash flow), and that means the capital required to get started is smaller, too. The Opportunity is real. The Formula is established. The success is already coming to people just like you (RALAcademy testimonials and reviews).

We have put together just about every type of resource and educational tool you could need to make the decision on whether or not RAL is for you, from the sought-after RAL Intro Course to the blueprint for creating a residential assisted living business plan, all the way to our premier event, the 3-Day Fast Track training program.There is a role for you to play, and as much as we hope you’ll get involved, our aging seniors need you to get involved.