There is a demographic time bomb set to go off that will usher in a new frontier of investment and profitability in the real estate market.

Population projections show that there will be a drastic shift in demographics in the U.S. This will create an unprecedented investment opportunity, as well as an overwhelming challenge for our nation to solve.

The senior population in this country is on the verge of expanding at an exceptional rate. This phenomenon has been dubbed the Silver Tsunami, and it has economists and health officials worried that this might be a potential crisis on the horizon.

Due to this massive surge in elderly populations, assisted living is about to be one of most explosive industries in business and real estate. Entrepreneurs and investors are scrambling to find a way to get involved and carve out their own slice of the pie.

So, what exactly is the Silver Tsunami?

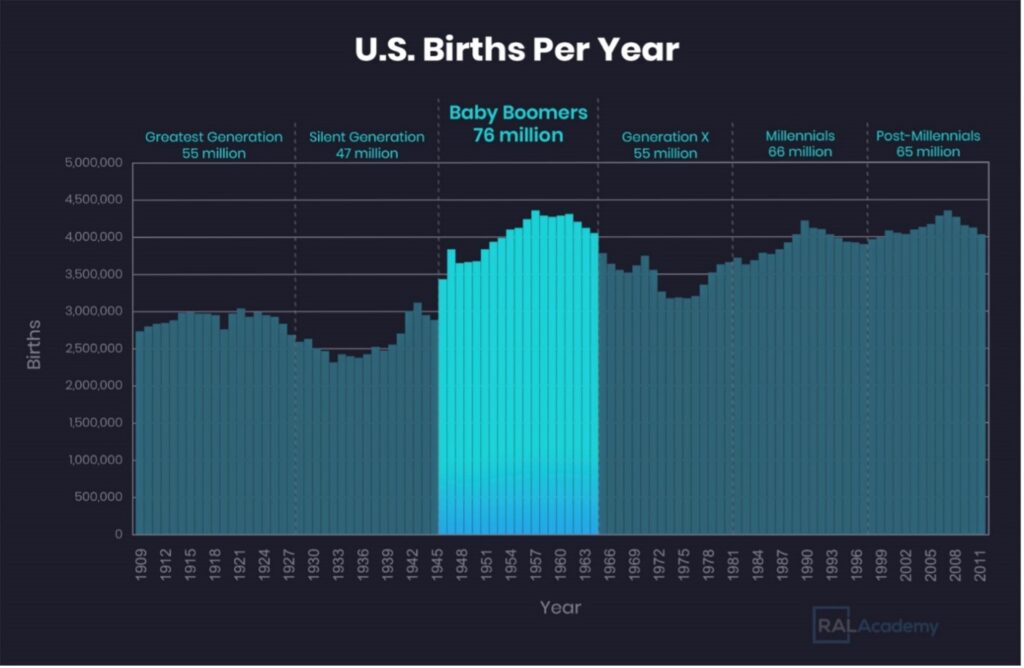

After World War II, there was an unprecedented spike in birthrates, commonly referred to as the baby boom. Because of this unique phenomena, Americans born between the years 1946 and 1964 were label the Baby Boomer generation. Birth records suggest that this group was comprised of 76-79 million people.

The Baby Boomers

The following graph comes from data compiled by the U.S. Census Bureau in 2011. According to their statistics, the Baby Boomer generation was the largest native-born demographic in American history. This group has only been rivaled by the Millennial generation, who in 2019 were the first group to surpass the Baby Boomer generation in size.1

The significant thing to note in the above graph is the difference between the number of births in the Silent Generation and the drastic rise in that of the Baby Boomer generation.

While the subsequent generations, i.e. Millennials and Post-Millennials also have strikingly high birth numbers, the Baby Boomer generation is the first to set such a trend. Therefore, it will be the first to test the capabilities and limits of America’s healthcare infrastructure and senior housing supply.

“Every day in the U.S., 10,000 people turn 65, and the number of older adults will more than double over the next several decades to top 88 million people and represent over 20 percent of the population by 2050. The rapid pace of change creates an opportunity and an imperative for both the public and private sector to harness the potential of the growing segment of society and to ensure the welfare of older Americans.”2

The first of the Baby Boomers reached the age of 65 years old in 2011. “Since then, there’s been a rapid increase in the size of the 65-and-older population, which grew by over a third since 2010.”3

As these baby boomers age through their 70s, 80s, and 90s it will send a bulging ripple throughout the U.S. population and completely shift the demographics in our nation. This will not only be significant in terms of preparing for the senior housing and assisted living crisis, this huge contingent of elderly citizens will significantly affect politics, legislation, healthcare markets and the economy as well.

Although the generations following the Baby Boomers, i.e. Generation X, Millennial’s, and Post-Millennial’s all have significant populations as well, the nation will have much more time to prepare for the needs of those groups as they age.

This is the reason that the baby boomer generation is so consequential to the senior housing industry. It is the first time in a modern America that there is a substantial difference in the size of a generation compared to the one preceding it. The Silent Generation, born between 1928 and 1945, are currently the majority of residents who occupy places and assisted living homes and facilities across the nation. Native birth figures for this generation are recorded a 47 million, and that is no trivial sum. But when you compare it to the following generation, the Baby Boomers, there is a more than 50% increase in the number of natural born U.S. citizens.

Combine this phenomenon with advances to healthcare and quality of life, which aids in overall longevity, and you end up with an active and robust generation entering their golden years with population numbers and economic resources never before seen in this country.

Another startling statistic is that, according to U.S. Census Bureau projections, “Older adults are projected to outnumber children under age 18 for the first time in U.S. history by 2034.”4

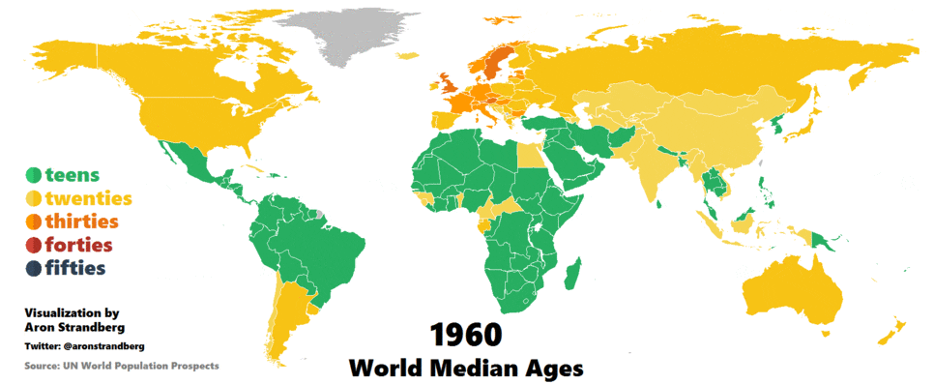

The U.S. is an aging country, and finds itself amongst the top quarter of oldest countries in the world. Population projections from the United Nations concludes that one out of every six people will be over the age of 65 by the year 2050. However, in America this number is expected to be more than one in five.5

“About 16% of the U.S. population was 65 years old or older in 2018, according to annual midyear population estimates from the U.S. Census Bureau, and the median age of America continues to rise – from 37.2 years in 2010 to 38.2 in 2018.”6

An Aging World

The world’s population is aging at a faster rate than ever before. People are living longer than any other time in history, and this will have an effect on economies, governments, and every area of the public and private sector.

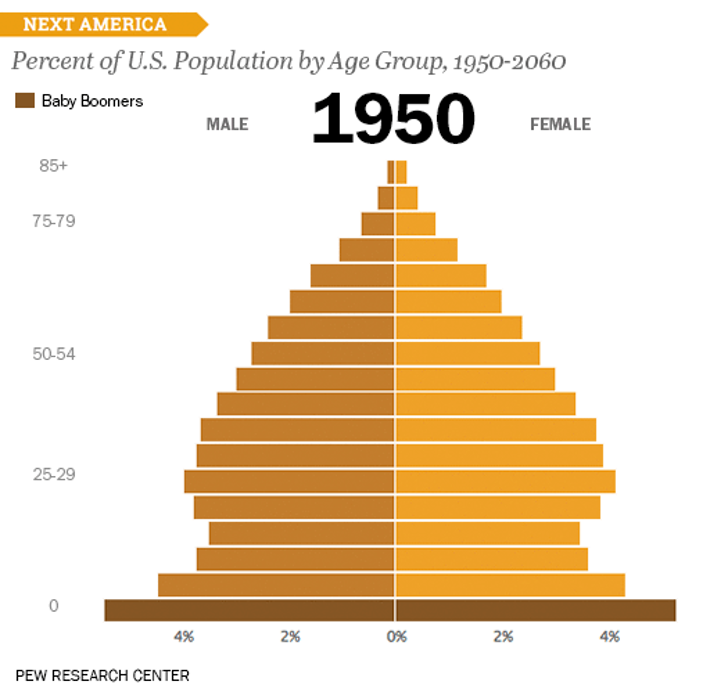

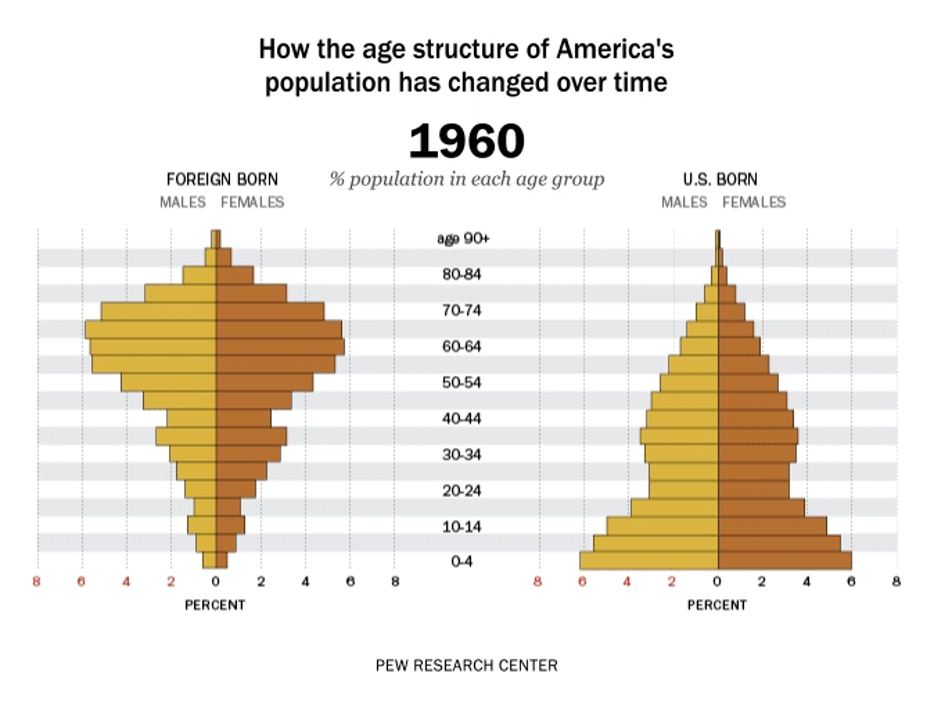

In the animated diagram above, the pyramid at the top grows significantly thicker, indicating that a greater number of Americans are living much longer than previous generations. This is due to a number of key factors surrounding improvements in life expectancy.

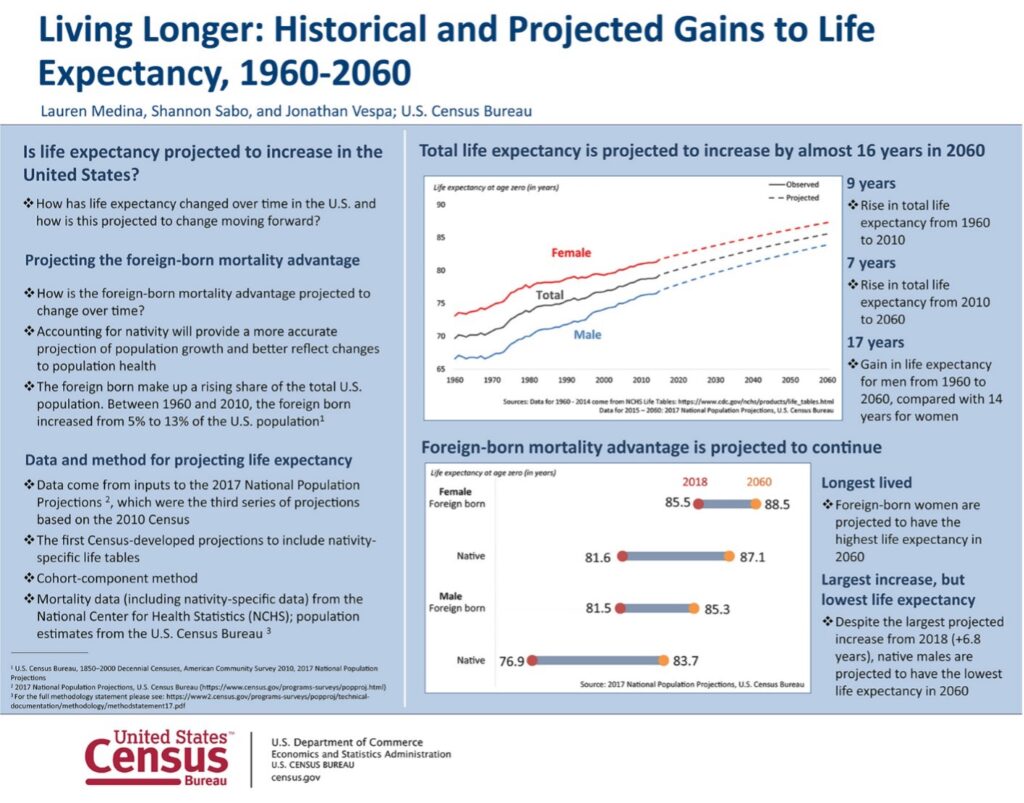

This country has seen incredible advancements in medical technologies, as well as the proliferation of agencies dedicated to the transformation of public health outcomes. Through research and education, we have also seen steady improvements to standards of living and hygiene across the board. Additionally, there has also been in overall decline in mortality rates and a reduction of infectious diseases in children and infants, leading too many more Americans reaching maturity and eventually old age.

All of these factors contribute to longevity and the extension of the median life expectancy of Americans. Next year, the oldest Baby Boomers will turn 77, and by the year 2030, all boomers will be at least age 65.7

Of the more than 10,000 Americans who turn age 65 each and every day, 7 out of 10 of them will require long term care in their lifetime.8 This reality will present huge challenges as well as opportunities as we prepare to meet the needs of this growing senior population.

Foreign-Born Residents Contributing to Senior Boom in America

The more than 76 million native-born Baby Boomers represent a massive percentage of the total U.S. population. However, that 76 million doesn’t even include the large number of people in the same age demographic that have immigrated to the U.S. from other countries.

If you look at the U.S. population as a whole, including both native and foreign-born Americans, it quickly becomes apparent that the rise in the number of elderly adults in this country is going to present a significant challenge.

Analyzing this data with a view to the current capacity and structure of the senior housing industry in America, it is easy to see the massive growth in demand and a potential crisis on the horizon.

Just like native-born populations, the U.S. will also have to find the solutions and resources to care for non-native-born elderly Americans as well.

Growth to Longevity

By 2050, the percentage of the American population aged 60+ will be 27.9%, which is up from 20.7% in 2015.

And the percentage of the American population aged 80+ will be 8.3% in 2050, which is up from 3.8% in 2015

On the face of it, 7.2% and 4.5% respectively, might not seem like a big deal. However, when you consider the projected U.S. population in 2050 will be 389 million people, those percentage increases represent 28 million more seniors aged 60+ and 17.5 million more seniors aged 80+. And that’s not including the entire U.S. senior population. That only accounts for the vast increase in senior numbers compared to the data reported in 2015.

By 2050, the entire projected number of seniors aged 60+ will be 108.5 million and the number of seniors aged 80+ will be 32.3 million. The infographic below shows the historical, current and projected life expectancies up to the year 2060.

The numbers we are talking about here are startling. This is why economists and industry experts are calling the aging Baby Boomer demographic a Silver Tsunami of seniors.

The United States is by no means the first country to experience an accelerated rate of growth in elderly population. Fortunately, we can look to other nations who have already started to deal with burgeoning elderly populations. If the U.S. takes action soon and builds the right kind of support and infrastructure, it may be able to limit negative impacts on the economy and society as a whole.

For example, Japan is currently the world’s oldest country, as it relates to the age of its’ citizens. More than 27 percent of the population in Japan is over the age of 65.

In 2018, Bloomberg reported that the number of Japanese seniors living alone increased by 600% between 1985 and 2015.9

Issues stemming from this out-of-control aging population have gotten so bad that elderly people in Japan are committing petty crimes in record numbers, with the goal of spending their remaining days in prison. There they can be sure of a bed, healthcare, and meals, and in many cases, prison staff are finding themselves having to function as caregivers.

About 40% of the seniors who commit petty crimes for this reason are not only economically vulnerable, but they often feel isolated and alone. They either don’t have family or are rarely able to interact with relatives.

Sweden’s senior population is not far behind Japan. About 20 percent of Sweden’s citizens are over age 65, in comparison to America’s more than 16 percent. Japan and Scandinavian countries are frantically trying to figure out how to best deal with this tsunami of seniors.

Meanwhile, many in the senior living industry are aiming to get ahead of the problem before it has disastrous effects in the United States as well.

The following animated graphic is a great visual to show just how much our world populations are aging.

“The mismatch between old and young will have implications across the coming years,” said Dr. Grace Whiting, president of the National Alliance of Caregivers. “We aren’t having enough children to take care of us in our old age. Look at my family: my in-law was one of six children, my husband and I were one of two, and we don’t have kids. Extrapolate that out, and that’s what’s happening nationwide.”10

The U.S. population is already becoming more fractured socially, politically, and economically. The paradigm of families remaining connected geographically is quickly becoming a thing of the past. Parents and grandparents are becoming more isolated, and it is more common for children to move out of state or across the country to build their own lives and families. As the older generations age, there will be some children and grandchildren who are able to relocate within the vicinity of their aging loved ones; where they will offer support and help with caregiving. However, most will likely choose to pay for assisted living rather than up root their entire lives, careers, and immediate family.

More and more families will turn to non-familial sources for support, and there will be an increasing need for health services, senior living facilities, and caregivers for people over the age of 65.

In the following infographic from Visual Capitalist, it shows the U.S. states that have the most residents over the age of 65. The average age of U.S. citizens has been on the rise for years, just like the same reality that has been playing out in nearly every developing country across the world.

More than 16 percent of Americans are now over 65, with Florida and Maine topping the list as the oldest states in the nation.

In summation, the United States along with the rest of the world is stepping into a new paradigm of aging citizens. The Baby Boomer generation has a significantly larger population than those previous to it. Combine this with an influx of foreign-born Americans, and the fact that all of these Americans are aging longer, and the result is a massive senior demographic who will need appropriate housing and elder care in their golden years.

This is why the aging baby boomer demographic is so significant.

From a housing and healthcare perspective, we simply don’t have the infrastructure to handle these numbers and care for such a large elderly population. And unless significant investment is made in the senior housing industry, we could be facing a major crisis.

Fortunately, we still have time to put structures and businesses in place to help meet this incredible demand. It will require a robust network of senior care homes as well as a comparable support infrastructure from the caregiver and healthcare community.

From Demand to Opportunity

It is because of this immense demand that the senior housing industry has drawn so much attention from investors and financial analysts. Add this demand to the fact that the senior housing market has a strong track record of investment performance returns, and you have a recipe for one of the biggest market growths of the generation.

Those who want to financially get ahead analyze prevailing trends and look for anomalies. They don’t go to where the money is, they go to where the money will be. The growth of the demand for senior housing encapsulates this very well.

When you are making the choice of where to invest your money, it is important to have a basic understanding of future trends and where industries are heading. Because they have made up such a significant portion of the U.S. population, Baby Boomers have been influential in driving our economy for the past 70 years. And all signs point to the reality that they will continue to have this influence on the economy as they enter their golden years, disrupting the senior housing market.

Within the 76 million Baby Boomers, the fastest-growing subset is the 85+ senior group. The worldwide population started quickly spiraling upward since the war, and the stability of these demographics are more reliable than stock market investments. The worldwide need for assisted living cannot be stopped, altered, or delayed. It’s a Silver Tsunami approaching, and we can see it years in advance, this allows us time to prepare ourselves. Those who become aware of these demographics and understand what they mean can position themselves to profit.

Although an overwhelming majority of seniors would rather stay in their own homes for the rest of their lives, this is often not possible due to age-related diseases and physical and mental decline. The reality is that seven out of ten seniors will need help at some point in their lives with their Activities of Daily Living (ADLs). These activities include everything that a person does in a day, i.e. getting out of bed, getting dressed, cooking, eating, medication management, and every other aspect of life. Some seniors only need a little assistance, while others require a lot. Either way, seniors generally don’t move into assisted living unless they need help with their ADLs.

With a Silver Tsunami of Seniors in need of assistance coming our way, residential assisted living is an incredible opportunity. It’s an opportunity for business-minded individuals to do good and do well.

The Profitability of RAL

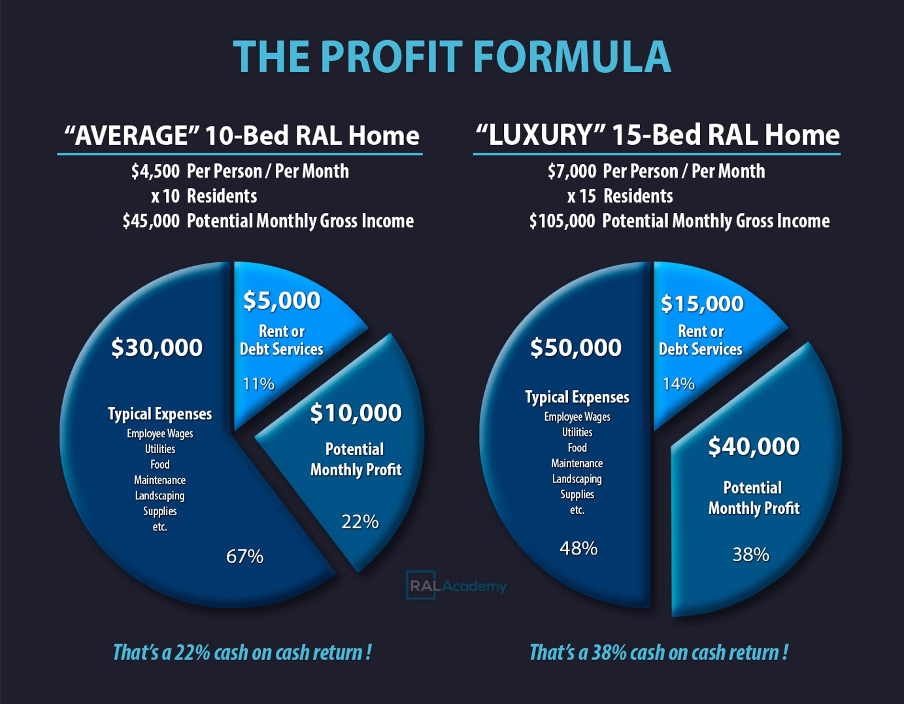

Residential assisted living represents a Value Add type of investment. The RAL formula it is a proven investment model unlike any other real estate play.

Let’s take a look at the most common options the entrepreneur has when they want to invest in real estate with a single-family home.

| Fix and Flip | $20K – $100K (1 time) | Cash Now |

| Rental Home | $200+ a Month | Cash Flow |

| Group Home | $1000+ a Month | Higher Cash Flow |

| Air BNB | $2000+ a Month | Even Higher Cash Flow |

| Own & Operate RAL | $10,000+ a Month | Highest Cash Flow |

When entrepreneurs look to invest in single-family residential rental properties they are generally striving to make an average of about 8% cash on cash return.11

But what does that look like in real terms? Let’s consider this example:

- You purchase a single-family rental property for $400,000.

- Pay an additional $20,000 in closing costs, maintenance, and repair.

- You begin renting the property out, charging your tenants $2,500 per month.

- Dividing your income by the expenses, and your yearly ROI would be just over 7%.

That may sound like a decent return for some entrepreneurs, but the reality is that many real estate investors end up making much less. Additionally, when you account for all of the extra expenses that can arise, unforeseen repairs, vacancies, the time and marketing costs to fill those vacancies, dealing with difficult and high-impact tenants, your cash on cash return can quickly vanish.

“Cash-on-cash return is a widely used metric for calculating real estate investment profitability. It measures the yearly return on an investment based on cash invested and net operating income. Cash-on-cash return will vary greatly depending on your financing method, such as whether you bought a property with cash instead of using a loan. According to most experts, aim for a cash-on-cash return that yields between 8% and 12%.”12

The following Profit Formula graph is an example of the ROI that many of our RAL Academy students are able to achieve with their residential assisted living businesses. Just look at the difference in the cash on cash return that investors can make using the RAL model with just ONE family home.

How many real estate investors would jump at the opportunity boost their cash flow and make a 22% cash and cash return?

Do we have your attention now?

A Competitive Real Estate Market

Traditional real estate investing is a very competitive exercise. The proliferation of real estate shows on TV, predominantly the fix and flip kind are constantly bringing a fresh group of novice investors who think they have what it takes to beat the system. Unfortunately, the sheer number of competitors in today has oversaturated the market. More competitors mean more bids for the limited inventory, which leads to overbidding, driving up market prices and squashing profit potential.

Although we are in an increasingly competitive real estate market, residential assisted living bypasses that competition by engaging the real estate market with a business that is driven by huge demand from the senior demographic as well as a stable and significant ongoing revenue stream.

Supply vs. Demand

There are about 28,900 assisted living communities in the United States today. And according to statistics from the Congressional Research Service, “In 2016, ALFs (assisted living facilities) provided capacity for 996,100 licensed beds. Settings ranged in size from 4 to 518 licensed beds, and the average bed capacity was 35 licensed beds.”13

In light of previously mentioned and well-documented demographic projections, experts believe that America will require 2,296,000 assisted living beds for aging seniors by the year 2029. That is more than double the current supply and represents an additional 1,300,000 licensed beds that will be needed in this country in the span of less than a decade.

When you look at these projections it isn’t hard to see the potential crisis that we are facing. However, at the RAL Academy, we choose to find the silver lining and focus on the potential opportunity.

The opportunity to…

- Help entrepreneurs and investors free themselves from the grind by building a cash flow business with unlimited income and growth potential that can take care of their family for life.

- Build RAL businesses that provide financial security regardless of what the markets are doing.

- Help elderly Americans and their families by providing quality care in a setting where seniors would prefer to spend their golden years.

- Make a significant and impactful contribution; Facing the potential senior housing crisis head on by owning a business that helps to fill a massive demand in our communities.

- Build a legacy of doing good with the ability to pass that legacy down to the next generation.

The figures surrounding supply and demand for senior housing and care are undeniable. As more entrepreneurs realize the potential in this market, there will hopefully be a greater response to take action and provide the RAL businesses to meet this demand.

“Someone turning age 65 today has almost a 70% chance of needing some type of long-term care services and supports in their remaining years. Women need care longer (3.7 years) than men (2.2 years). Nearly one-third of today’s 65 year olds may never need long-term care support, but 20 percent will need it for longer than 5 years.”14

Location is Key

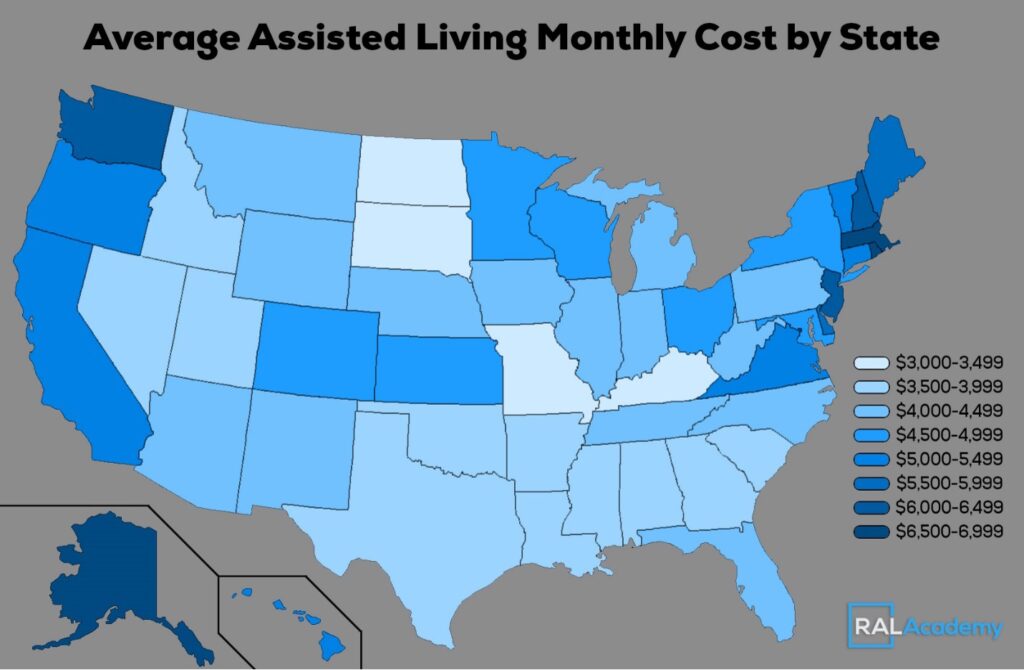

The cost of senior housing and elder care varies based on the care setting, geographic location, and level of care required, among other things.

The map in the image shows the average cost seniors pay for assisted living in their state. However, at the RAL Academy, we teach you how to design higher-end residential assisted living businesses with higher quality standards, for clientele who have the means and want to pay more for better care, accommodations and amenities.

The Real Estate & The Business

Residential assisted living offers investors the opportunity to be practically recession proof. In fact, senior housing is one of the only sectors that saw a net increase in the rates charged year-over-year during the Great Recession of 2008.

One of the keys to economic resilience in spite of market turbulence is generating passive income; specifically, income that can be increased along with inflation.

Having the right business at the right time is critically important to your success. Anyone can make it in business, but the level of your success depends on timing and doing your homework to find the right opportunity to invest in.

The beauty of investing in the RAL model is that it combines the stability of real estate investment, the tangible asset, with a proven business formula that creates continual substantial cash flow. But unlike other single-family home investment options, the monthly rentals you receive are significantly greater.

There are a number of ways that you can make money investing in residential assisted living.

Option #1: Own the Real Estate and Rent It Out

You can own real estate and rent it out to someone who will run the assisted living business. In this scenario, your participation is extremely hands-off. You are not even involved in the senior living business because you are simply acting as the landlord. Similar to commercial real estate, you are renting out your property for a business to use; that business just happens to be residential assisted living.

Experts have been saying for decades that real estate is the best investment because it’s unlike other investment types, it is concrete, it is tangible, a piece of land that doesn’t just exist on a ledger in a computer.

If you choose to simply own the real estate and lease it to a RAL operator, the rent you set can be substantially higher than fair market rents you would normally be able to charge renting to a family or using the Airbnb model. This is because of the lucrative nature of running a RAL business. RAL operators provide care for seniors and that generates significant stable income. As a hands-off investor who only owns the property, you can increase rents you charge each year as the operator increases their rates of service.

Option #2: “Mom-and-Pop” Operation, Owning and Operating

The second option is one that you can see employed by entrepreneurs all across the country. It is the “mom-and-pop” operation. Owning a thriving business is great because of the cash flow it generates. With the second option, the RAL business is typically owned and operated by someone who lives in the house and provides the care for the residents themselves. They have few if any employees and they have little if any freedom of time. This is an option that we don’t advocate for, and one that we actively discourage investors from using.

Many entrepreneurs choose to invest in assisted living because they are tired of the grind of a normal job. They want to build their own business and be the captain of their own ship. But when you choose to operate your business in this way, where you are the manager, the caregiver, the cook, the cleaner, etc. you don’t actually own the business, the business owns you.

Option #3: The RAL Academy Model, Own the Real Estate AND the Business

Finally, the third option is the RAL Academy model, and the formula that we use to teach thousands of entrepreneurs to employ across the nation. In this option, you own the real estate AND the business. In this situation you are building equity with a valuable real estate asset while creating substantial continual cash flow from a thriving business. It’s the best of both worlds.

The Market

It is clear that the demand for senior care is massive and the data is showing that is only set to grow for the next two decades. As more investors recognize the profit potential in this industry we are seeing small and large operators making moves to secure their spot at the table. But what does the competition actually look like?

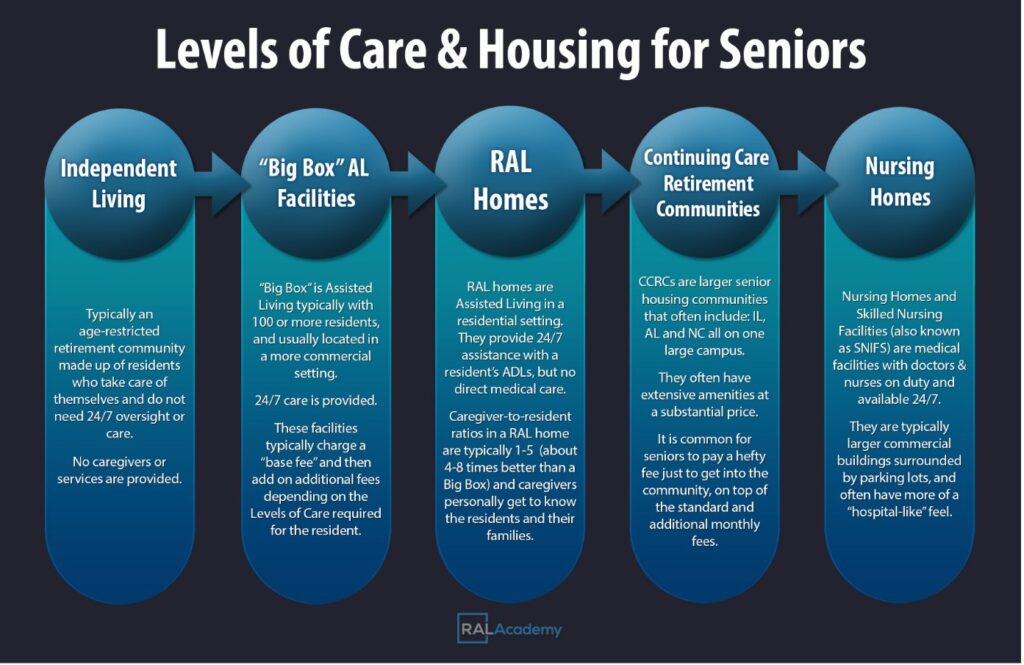

Following graph shows the five basic types of senior living facilities that are currently available for older adults.

For many seniors, the first step beyond the comfort of their own home is independent living. This model consists of retirement communities that are typically age restricted. The residents live independently, taking care of themselves and do not need care or general oversight. The appeal of this model is the community that can be built amongst seniors who may feel isolated or alone in their own homes years after their children have left. Being surrounded by other elderly adults with similar interests and hobbies can provide solace and keep seniors engaged socially.

The next level of senior living is a traditional assisted living facility, also known as “big box” assisted living. These large facilities typically have upwards of 100 or more residents with a much larger caregiver to resident ratio. They often have the look and feel of a nursing home, only they tend to not offer skilled medical professionals in the way that nursing homes do. These facilities are expansive, they have massive budgets, and the cost to house a senior in this environment reflects this, with exorbitant fees in spite of providing less personal care. From a financial standpoint, when you measure our residential assisted living model against the big-box senior living corporations like Brookdale, Atria and Sunrise, there’s no comparison. These senior living giants are happy to achieve 3-6% returns on their capital. This is because they are investing billions, and so a 3-6% return on such a large sum represents a significant profit. The RAL Academy model, which operates on a much smaller scale, regularly provides a 20-40% cash on cash return.

In terms of profitability as well as care provided, residential assisted living shines. This model is also part of the traditional assisted living market, except it is found in a residential neighborhood, in a single-family home. This is the environment that is most similar to the senior’s own personal home. It is where seniors prefer to live. And it offers the potential for excellent care with lower caregiver to resident ratios. This is the model we used to help entrepreneurs and investors make the biggest impact senior housing.

When most people think of senior housing and elder care they generally think of nursing homes. This senior housing category, also known as skilled nursing facilities, provide a much greater level of medical care. There are nurses on staff 24/7 to take care of every health issue facing the residents, and the facilities end up feeling more like a hospital. Unfortunately, this is where many seniors and up spending their final days.

Finally, there are continuing care retirement communities, also known as “life plan communities.” These are large senior living communities that often include independent living, assisted living, and nursing home care all in the same vicinity.

Some of these CCRCs are quite impressive. Beautiful and immaculate structures with impressive amenities. Unfortunately, all of these amenities and luxuries come at a huge price. Most seniors will never be able to afford even a fraction of the fees and monthly rents that these large facilities charge.

The Recession-Proof Reputation of Senior Living

It is no secret that warnings are sounding in every financial sector in America, pointing to an upcoming economic recession. Stability is constantly being tested in an ever evolving financial landscape. And just like previous economic downturns and recessions, there will be winners and losers; those who stand to build fortunes in light of opportunity, and those who miss the boat.

The reality is, when you look around and see continual inflation, rising interest rates, supply chain issues, and slumping financial markets, there is a real cause for concern.

Regardless of the industry or asset class, investors are always looking for a combination of stability and opportunity.

On the whole, the senior living industry is known for being fairly recession proof. In fact, senior housing was one of the rare real estate product types that weathered the Great Recession well.

Unlike other industries, senior living and senior care is a needs-based market, and that doesn’t change when the rest of the economy is in turmoil. And with the impending Baby Boomer generation starting to enter their senior years, where many of them will need care and assistance with activities of daily living, the senior living industry is forecast to only grow in the next two decades.

While it is true that certain parts of the senior living sector took a financial hit during the pandemic, it was mainly felt in the big box assisted living communities, large nursing homes, and continuing care retirement communities. The assisted living homes, especially those in a residential setting with small occupancy numbers generally fared quite well. And aside from a few changes in daily operations, i.e. social distancing, mask wearing, COVID testing, etc. for many residential assisted living homes it was business as usual.

Outside of a worldwide pandemic, the senior housing industry has been a bastion of growth and financial stability for investors over the past few decades.

There are residential assisted living homes across the nation with long wait lists. For most of these RAL owners, the potential of recession isn’t as looming of a concern as it is for most other industries. Regardless of what is going on in the market and overall national economy, the demand for care and senior housing is still going to be there, because it is driven by needs that generally can’t be met in any other way.

Consider the family who has place their elderly parent or grandparent in a care home because they don’t have the skills or flexibility in their schedule to care for them. The average family in that position isn’t going to remove their loved one from a care home during a recession, because irrespective of the financial strain, their schedule is likely just as busy as before, and they are still unlikely to possess the skills to care for their loved ones’ needs.

For families like this, the tightening of the financial belt will result in cutting expenses in other areas, and probably not in limiting or eliminating the care for their elderly loved one.

The Resilience of Assisted Living

One of the most significant benefits of assisted living for the investor is stability in spite of shifting trends, economic downturn, and recession. The demand for senior housing is tied directly to demographics and the burgeoning population of elderly Americans.

To put it plainly, Americans are aging; Americans will continue to age regardless of what the market is doing; at some point aging Americans will require senior living accommodations and assistance with activities of daily living. This has been the paradigm for a long time, and it doesn’t look like it is going to change any time soon. The only thing that is different is that, because of the immense increase in natural births from the Silent Generation to the Baby Boomer Generation, over the next few decades we will see an unprecedented rise in the need for senior housing and care as this group ages.

The demand is there. This demand will only grow larger in the next two decades. No economic disturbances or instabilities will change those facts. This is one of the main reasons that assisted living and senior housing has been one of the most successful real estate sectors in the past decade, and is projected to continue this trend well into the middle of this century.

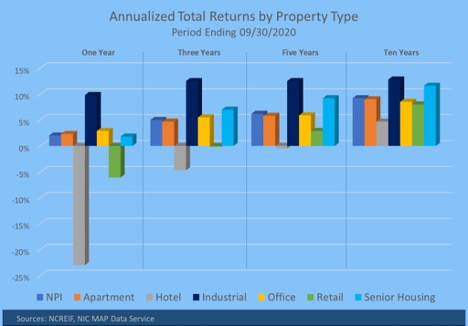

In the graph below, analysis of various property types over the past 10 years shows that senior housing has outperformed all other real estate types except for the industrial class.

When you compare the returns on residential assisted living to other real estate asset classes, there really is no comparison.

This is why so many investors, both experienced and novice alike, are rushing to find their place at the table in this booming market. Over the last decade, entrepreneurs at every level have been turning to assisted living, not only for cash flow and profit, but also for stability and the ability to ride out economic turbulence.

More Than Just a Financial Opportunity

We have discussed the immense demand for senior living. We’ve analyzed why this demand is growing so rapidly, and addressed how it is going to create a potential crisis if we fail to do something about it. We have also looked at the opportunity that residential assisted living presents for investors who want to yield significant return on investment while creating cash flow in a business that is resilient to economic fluctuations.

However, there is one more reason that the residential assisted living investment opportunity is so unique, and the main reason why the RAL Academy was founded. It is that this investment opportunity actually changes lives.

- It changes the lives of the investors.

- It changes the lives of the senior residents and their families.

- It changes the lives of the caregivers and support staff.

The Investors

When you take a look at the profitability of the residential assisted living opportunity, it quickly becomes clear how investing in RAL homes can change the life of the investor.

Investors, owners, and operators of RAL homes get involved in the residential assisted living opportunity for a number of reasons. Most want to create a business with unlimited income and growth potential. They want freedom from the 40-hour work week in a 9-to-5 job, working for someone else, helping achieve their bosses’ dreams, rather than their own. They appreciate the hands-off approach that allows them to work “ON” their business without having to work “IN” their business.

RAL investors love that they can build a business that makes substantial and continual cash flow while also making a significant and meaningful impact in their communities. They want to make a difference, not only in the present, but to build and pass on a thriving business – a real legacy for their families.

The data scientists and economists have crunched the numbers. They have rung the alarm bells about this drastic shift in senior demographics and what it means for the health and economic future in this country.

Those who are investing in RAL businesses right now are part of a movement. They are the first wave of support looking to tackle the needs of the impending Silver Tsunami head on. And just as with most investment opportunities, the early adopters are the ones who stand to gain the most.

Our founder, Gene Guarino, spent countless years researching and employing the best practices for RAL business operations in his own residential assisted living homes. From first-hand experience, he understood the lucrative potential of this business model as well as the incredible opportunity to help others in need. This is why the RAL opportunity is unlike any other, and why the RAL Academy motto is “Do Good and Do Well.”

Some entrepreneurs might still be skeptical, even after hearing about the incredible benefits this investment opportunity provides. That is completely understandable.

You might be saying to yourself, “If this is such a lucrative investment, then why don’t you keep these secrets for yourself and reap all the rewards?” This is a common critique of investment opportunities, and a question that should be asked about any business or organization. But the reason that the residential assisted living investment opportunity is so unique, and why the RAL Academy is determined to share this opportunity with as many people as possible, is due to the original demographics we talked about.

At this moment, the U.S. isn’t ready for the massive growth in demand for senior housing over the next two decades. Right now we don’t have the number of assisted living beds that will be required by this next wave of seniors. The facilities, infrastructure, care staff and support teams needed to care for these seniors aren’t in place yet. That is why we share our business secrets and expertise.

We have the tools, the resources, and the proven systems to make RAL businesses extremely profitable, but we can’t open tens of thousands of RAL homes across the country on our own. This is why the RAL Academy was founded; to help entrepreneurs and investors understand the opportunity and find the best path to quickly create the successful and profitable RAL businesses that will care for our nation’s seniors.

This is where you come in. As you are reading this right now, just know that you are in the right place at the right time.

In reality, the many ways that residential assisted living changes the lives investors are as varied as the number of investors themselves. If you would like to learn more about what we do and what kinds of investors are involved in residential assisted living, you can hear directly from our students.

Throughout our websites and social media profiles you can find hundreds of testimonials and success stories from RAL Academy students who have had life-changing experiences investing in residential assisted living homes. But don’t take our word for it. You can start exploring many of their stories here: https://residentialassistedlivingacademy.com/testimonials/

The Residents

For many investors the reason that residential assisted living is such an attractive investment is because it offers a solution to the senior housing crisis in a way that seniors actually prefer to live.

For decades, it has been common practice to collect our elderly into large, cold, hospital-like facilities and nursing homes, sequestered away from the rest of society. The fees for these places are usually incredibly high, and the residents often feel like they are just another number.

Even with a decent team of caregivers and support staff, these large institutions are still isolating, depressing, and lonely. The big-box facilities are just not a home, and they are not places where anyone would have dreamed to spend their twilight years.

On the other hand, residential assisted living meets the same demand, providing eldercare and housing, but in a home-like environment. The caregiver-to-resident ratio is much better in a residential assisted living home, providing seniors the opportunity to receive more personalized care.

It is true that most seniors would prefer to remain in their own homes, places of comfort that they have spent a large portion of their lives. But when this is no longer an option due to health or safety concerns, families are presented with the choice of where to place their aging loved one and what care will be needed to provide for them.

It may take a while to come to terms with the reality of the situation, but eventually an elderly parent or grandparent begins to realize that they require some sort of assisted living arrangement. And when given the option, the senior will most often choose to live in a residential assisted living home, rather than a big box assisted living facility.

When RAL homes are run well, they offer the opportunity to greatly improve the lives of seniors and their families.

The Staff

By choosing to invest in residential assisted living, entrepreneurs aren’t just creating financial opportunity for themselves, but also for their support staff, caregivers, and the various ancillary roles connected to the RAL business.

It is true that when most people think about assisted living they imagine the historical paradigm of nursing homes and large hospital-like facilities. Cold, sterile places where seniors are isolated and/or abused.

Most people would express their displeasure at the reality of how we treat the elderly. But did you ever stop to think about the real people that work in those facilities across the nation? Do you think they really wanted to work in a job that marginalizes and does little to actually care for the residents beyond their medical needs?

Most people who get into the business of caring for seniors chose to do so because they have a genuine concern for elderly people. Historically, the assisted living industry hasn’t just failed the elderly; it has also failed those who spend their days trying to care for them.

The people who were drawn to the medical field because they wanted to help others make a real difference, they are also at a disadvantage when it comes to the big-box facilities.

They have to interact with so many elderly people on a daily basis who are nearing the end of their lives, and invariably have to watch as their residents succumbed to the eventuality of aging.

What’s more is that medical professionals and caregivers in the big box institutions are often encouraged to try to remain aloof and un-phased by the realities that come with aging seniors. Caregivers in these settings often keep themselves emotionally distant, not because they are necessarily bad employees, but usually as a defense mechanism in an effort to retain some sort of emotional stability. These places can become emotionally damaging to both the residents and the staff. In a big-box facility with hundreds of residents, these caregivers have become used to so many seniors passing away, and this often impacts their ability to truly care for their residents in a compassionate and holistic way. They get into the field of senior care to try to make a difference, but end up limiting the difference they are able to make as a means of emotional self-preservation.

For those who don’t work with seniors on a daily basis it can be hard to relate. Because without actually walking a mile in their shoes, it would be difficult to understand just how emotionally overwhelming it is to have to go to a job every day where the people you serve my not be there tomorrow.

We understand the toll that comes with caring for such a large number of seniors and big-box facility. That is one of the reasons why we believe residential assisted living is the best option for senior residents, care staff, and assisted living business owners.

Identifying Your Why

Is residential assisted living an incredible investment opportunity that has the potential of making investors lots and lots of money?

Yes. It absolutely is that rare kind of investment opportunity.

But this isn’t just an emotionless cash grab type of investment. If your only concern is money and making as much of it as possible, then this might not be the opportunity for you. After all, there are plenty of other ways to make money that require little to no humanity or empathy.

However, if the idea of making a lot of money while helping others and meeting a huge demand in the market is something that appeals to you, then this might be something you want to explore further.

The residential assisted living opportunity is essentially a real estate play combined with a business model that requires a great deal of character. At the heart of this investment opportunity is the desire to provide quality accommodations and care for seniors.

That doesn’t mean that you need to be the one providing the care, but you do need to have the insight into hiring the right people that will provide quality care for seniors.

Everyone in this industry doesn’t work directly with seniors day-to-day, but it does require a general level of understanding and compassion.

Many of our RAL Academy students operate their residential assisted living homes with a hands-off approach. We teach them how to build their businesses and hire the best people to manage and care for the residents so the owner can have the freedom to pursue other interests and opportunities.

While there are plenty of RAL business owners who prefer to be more hands-on with the day-to-day running of the business and caring for seniors, the RAL Academy model focuses on teaching investors how to build the right teams, systems and procedures so that the investor can be more independent with their life choices.

Why We Do This

At the RAL Academy, our mission is to help motivate, train and support others to start, own or operate RAL homes across the country, providing high quality care and positively impacting millions of people.

We see the huge demand on the horizon and we want to help prepare our communities to meet that demand, making sure that our precious seniors are taken care of with quality, dignity and comfort.

The Demand for Memory Care

It is difficult to have a complete conversation about the growing need for assisted living without addressing the elephant in the room. Alzheimer’s disease and other forms of dementia make up a sizable portion of the reasons that seniors need assisted living in the first place.

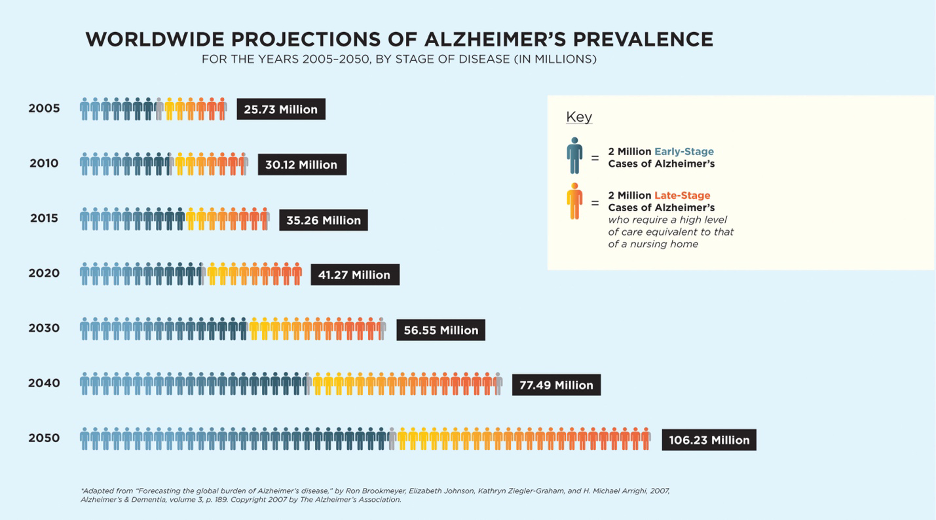

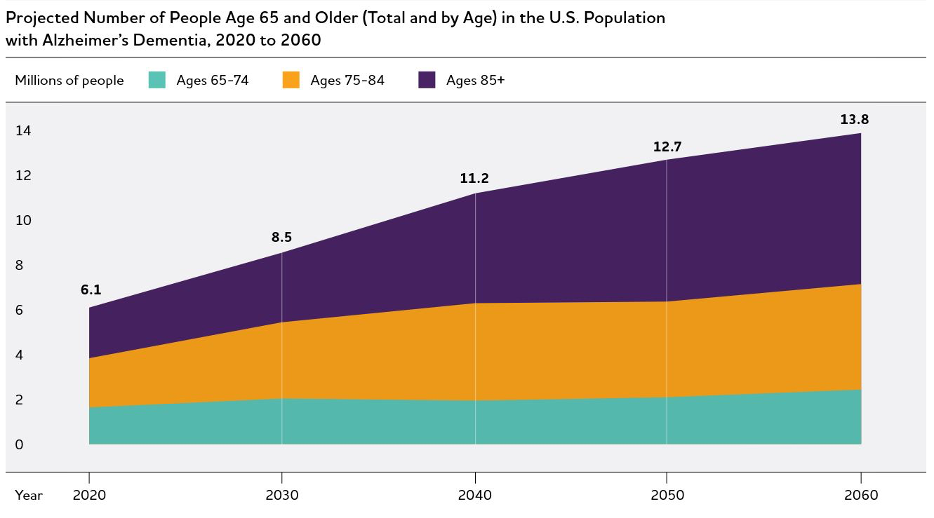

The statistical projections that mental health experts have presented in the last few years, paint a compelling picture of the impact this group of cognitive diseases will have on an aging world. Alzheimer’s disease, is the most widely recognized and also the most common cause of dementia. It accounts for an estimated 60 to 80 percent of all dementia cases. The following graph uses data from the Alzheimer’s Association and shows the current and projected prevalence of Alzheimer’s disease, not including other forms of dementia, throughout the world.

For a little background, the term dementia does not represent a specific disease but is rather a general term for the loss of memory, language, problem-solving and other thinking abilities that are severe enough to interfere with daily life. And although dementia predominantly affects older adults, scientists have concluded that it is not a part of normal aging.

If this drastic increase is what the world is facing, just how common is dementia in America? According to the CDC, “of those at least 65 years of age, there is an estimated 5 million adults with dementia in 2014 and projected to be nearly 14 million by 2060.”15

How does this relate to residential assisted living?

The reason that these numbers are so significant is that cognitive disease represents an additional layer to the impending Silver Tsunami and senior housing crisis that is coming our way. It will have a massive impact on millions of people and their families across the U.S. and abroad.

Cognitive declines associated with aging and disease contribute to a significant amount of senior housing demand. And from the investor’s perspective, this presents a huge opportunity.

Many assisted living homes and facilities across the country have employed a memory care model of service. At the RAL Academy, we have experts and professional memory care operators who have been on the front lines of this battle for years.

So, what is memory care?

It is a specific form of long-term care that caters to patients with Alzheimer’s disease, various types of dementias, and other cognitive impairments. This type of care demands a number of special considerations. Some of these considerations include specialty staff training, unique physical layout of the care home with an easy to navigate environment, and the proper security in place to ensure safety for the residents and staff.

Assisted Living vs. Memory Care

How is memory care different from traditional assisted living? In short, memory care is a form of assisted living where a number of physical and procedural changes have been made to the AL home in order to accommodate the needs of those with cognitive impairments. The following lists provide an insight into the basic distinctions between the two types of care.

| Assisted Living | Memory Care |

|---|---|

| Residents may be more independent, but they will still need help with some ADLs and personal care tasks. Residents typically do not require the same level of oversight that is required for memory care. There is less structure in the daily routine and more autonomy for the residents. | Residents are more closely monitored by staff who are specially trained to help with cognitive challenges. Residents generally have a more structured daily routine to reduce stress and provide stability, and activities are geared towards creating more positive experiences. Additional security measures are put in place to reduce wandering and preserve the safety of residents. |

For the investor, memory care provides an incredible opportunity and comes with many added benefits. Firstly, memory care homes provide higher than average rents, typically bringing in between $1,000-$2,500 more per resident, per month. Additionally, it is much easier to keep beds full in a licensed memory care home.

Memory care residents on average also tend to stay longer in assisted living homes compared to non-memory care residents. And when your home is licensed to provide quality memory care you have the opportunity to be flexible, accepting both memory care and non-memory care residents.

Residential assisted living homes that are licensed to provide memory care provide a better experience for memory challenged seniors than the big-box facilities. This is because the smaller home-like environment has fewer people constantly coming and going from the home. There are less distractions and a lower potential for negative interactions. As well as the fact that a lower resident to caregiver ratio is more ideal to serving those with memory care needs.

A licensed memory care home is also more marketable and can really help set the RAL investor’s business apart from surrounding competition. The more tools you have in your toolbox and the more care options you are able to provide make it even easier to compete with the big-box facilities.

When you provide high-quality care and a better resident experience, your reputation will proceed you. Seniors and their families will seek you out because you and your team are able to meet the needs of a wider array of prospective clients.

Why We Are Different

Plain and simple, we believe that there is a better way to care for our nation’s elderly. The Residential Assisted Living Academy was established from a desire to see real change in the senior housing industry.

Our founder, Gene Guarino, became interested in senior housing because he needed a home that provided quality care and comfort for his mother in her later years. After experiencing numerous assisted living facilities, he came to the conclusion that the care that was available was not sufficient. So he devoted years and countless hours researching every facet of assisted living in an effort to provide the best possible option for aging seniors. Throughout this process he came to the conclusion that residential assisted living is not only best way to care for the elderly, but is also an incredibly profitable business. Once this reality came to light he began establishing systems, procedures, and a path for others to follow who also want to invest in this market. He had no one to teach him about this business, but through his own trial and error, he unearthed an incredible opportunity for both investors and those looking to help others. Because of his leadership and vision, the RAL Academy is dedicated to helping raise standards in the assisted living industry and empower entrepreneurs to make a difference in the lives of seniors and their families.

The reality is, the Silver Tsunami of Baby Boomers is on its way whether we’re ready or not. And rather than view the oncoming flood of seniors needing care as a potential crisis, we are placing ourselves in the best position to help train others to meet this immense demand.

Although we have already trained thousands and most of our instructors and support staff have their boots on the ground as either owners, operators or directly involved in the running of residential assisted living homes, we are going to need a lot more help to face this crisis together.

We need people like you.

We want to help seniors live their best lives possible. We believe that everyone at any age should have the opportunity to live a purposeful life with comfort, security and dignity. Every single person is unique and has their own set of values, comforts, and desires of how they want their twilight years to unfold. Senior housing should be unique as well. It shouldn’t be a cookie-cutter pattern, a one-size-fits-all approach to senior care.

We don’t accept the paradigm of grouping large numbers of elderly adults into facilities where they become just a number, looked after by staff who are either indifferent or too busy and overwhelmed to provide the care and attention that their senior residents deserve.

We want to ensure that the elderly, their stories and their life experiences aren’t lost. We want to help prepare communities across the nation to take care of our seniors.

As Gene always used to say, “We are all going to get involved in assisted living one way or another. Either you or a loved one will be living in the home, writing a check to someone to take care of you. Or you could own the business, live for free, and pass a successful cash flow business on to your family when you are gone. How you choose to be involved is up to you.”

Final Thoughts

The bottom line is that this industry is set to explode and present an investment opportunity that only comes around once-in-a-lifetime.

The time for action is here. This is the best time to get started investing in residential assisted living. Regardless of what is happening in the world or what the markets are doing, seniors will still continue to age and need both suitable housing and excellent eldercare.

If you are looking for freedom, financial security, substantial continual cash flow, the opportunity to build a legacy that you can pass on to your family, then residential assisted living just might be the answer for you.

Is it time for you to get out of the rat race and start building your future? If you don’t build your dream, someone else will hire you to build theirs.

The demand for senior housing is undeniable. More and more investors are learning about this opportunity every day and finding their seat at the table. This opportunity might not be for everyone, but if it sounds like something you want to be a part of, don’t wait to take the first step.

The Silver Tsunami of seniors is coming. The only question that remains is how will you choose to be involved?

References

- Pew Research Center. Millennials overtake Baby Boomers as America’s largest generation. https://www.pewresearch.org/fact-tank/2020/04/28/millennials-overtake-baby-boomers-as-americas-largest-generation/

- AARP Aging and Readiness Arc. https://www.aarpinternational.org/initiatives/aging-readiness-competitiveness-arc/united-states

- U.S. Census Bureau Releases 2019 Population Estimates by Demographic Characteristics. https://www.census.gov/newsroom/press-releases/2020/65-older-population-grows.html

- U.S. Census Bureau. https://www.census.gov/library/stories/2019/12/by-2030-all-baby-boomers-will-be-age-65-or-older.html

- United Nations. World Population Aging 2019. https://www.un.org/en/development/desa/population/publications/pdf/ageing/WorldPopulationAgeing2019-Highlights.pdf

- U.S. News. Aging in America, in 5 Charts. https://www.usnews.com/news/best-states/articles/2019-09-30/aging-in-america-in-5-charts

- U.S. Census Bureau, International Population Reports, P95/16-1, An Aging World: 2015. https://www.census.gov/content/dam/Census/library/publications/2016/demo/p95-16-1.pdf

- Genworth Cost of Care Analysis. https://www.genworth.com/aging-and-you/finances/cost-of-care.html

- Bloomberg News. https://www.bloomberg.com/news/features/2018-03-16/japan-s-prisons-are-a-haven-for-elderly-women

- U.S. Census Bureau. https://www.census.gov/library/stories/2019/12/by-2030-all-baby-boomers-will-be-age-65-or-older.html

- https://www.steadily.com/blog/what-is-the-average-cash-flow-on-a-rental-property

- https://www.biggerpockets.com/blog/defining-successful-roi

- Congressional Research Service. Overview of Assisted Living Facilities. https://crsreports.congress.gov/product/pdf/IF/IF11544

- https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

- Centers for Disease Control and Prevention. Alzheimer’s Disease and Healthy Aging. https://www.cdc.gov/aging/dementia/index.html

- Alzheimer’s dementia projections. https://www.alz.org/media/Documents/alzheimers-facts-and-figures.pdf